Why Nordic corporate bond investors should care about defence spending

The recent shift in US foreign policy has underscored the need for Europe to increase its defence spending and develop a more autonomous defence strategy for regional security. The US administration has indicated that its military focus is pivoting away from Europe, prompting European nations to assume greater responsibility for their own defence.

Sweden, for instance, announced in October 2024, that it plans additional military spending of 170 billion krona (€15 billion) plus 37.5 billion krona for civil defence through 2030 — on top of the existing budget. That will put Sweden’s defence budget at 2.6 percent of GDP by 2028, well above NATO’s target of at least 2 percent. While additional spending plans in Europe are not yet known, the current geopolitical realities almost certainly imply that budgetary defence spending will increase significantly, an assumption that also seems to be investors’ conviction.

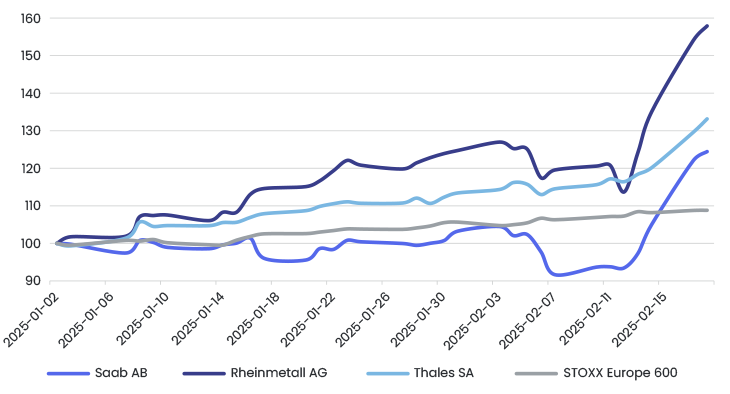

Figure 1. Stock price development, selected stocks

Indeed, European defence companies have seen significant stock market gains, driven by investor anticipation of increased military spending. For example, following the Munich Security Conference on 14-16 February, shares of Rheinmetall surged by 14% in Frankfurt, Saab rose by 16% in Stockholm, and Thales saw an 8% increase in Paris. The Stoxx Europe Aerospace and Defense Index reached its highest level since the 1990s.

Higher spending, higher rates: The case for floating rate notes

Financing these increased defence budgets may involve reallocating funds from other sectors, securing additional external capital, or a combination of both. Given the urgency, initial investments are likely to be substantial, focusing on expanding existing production capacities and stimulating new infrastructure projects. While long-term defence spending could be managed through budgetary reallocation, immediate and significant spending may require the issuance of government bonds.

However, such unfunded spending carries inflationary risks, potentially leading to higher interest rates. Increased financing needs may put upward pressure on bond yields, as governments may need to offer more attractive rates to attract investors. Recent trends have shown a depreciation in European bond values, with 10-year yields for Germany, France, and Italy rising significantly. This development reflects market concerns about escalating military spending and its macroeconomic implications.

In summary, the evolving geopolitical landscape requires Europe to strengthen its defence capabilities, leading to increased military spending. This shift is having an impact on financial markets, with defence sector stocks rising and government bond prices coming under pressure from expected higher interest rates. Investors may need to consider shorter-duration bonds in their portfolios to mitigate potential interest rate risks associated with this new fiscal environment.

Positioning your portfolio for the new market reality

With defence spending rising and interest rates likely to remain elevated, positioning in floating rate Nordic corporate bonds offers an attractive way to capture yield without excessive duration risk. If you’re looking to optimise your fixed income exposure in this environment, now is the time. Consider the opportunities in our fund.